Forgot Your SARS Password? Here’s How to Reset It Without Visiting a Branch

Forgetting your SARS (South African Revenue Service) password can be frustrating, especially when you need to access your tax information quickly. Fortunately, SARS offers convenient online options to reset your password without the hassle of visiting a branch. In this article, we will guide you step-by-step on how to reset your SARS password easily and securely from the comfort of your home.

ALSO READ: Owe SARS Money? Here’s What Happens If You Don’t Pay by the Deadline

Why You Might Need to Reset Your SARS Tax Password

Many taxpayers forget their SARS password due to infrequent use or complex password requirements. Additionally, security protocols may require you to update your password periodically. If you enter the wrong password multiple times, your account may get locked, making it necessary to reset your password to regain access.

Step-by-Step Guide to Reset Your SARS Tax Password Online

Resetting your SARS password online is straightforward and can be done in just a few minutes. Follow these simple steps:

- Visit the SARS eFiling Website

Go to the official SARS eFiling portal at https://www.sarsefiling.co.za. - Click on ‘Forgot Password?’

On the login page, locate and click the “Forgot Password?” link below the password field. - Enter Your Username

Provide your SARS eFiling username or your South African ID number to identify your account. - Verify Your Identity

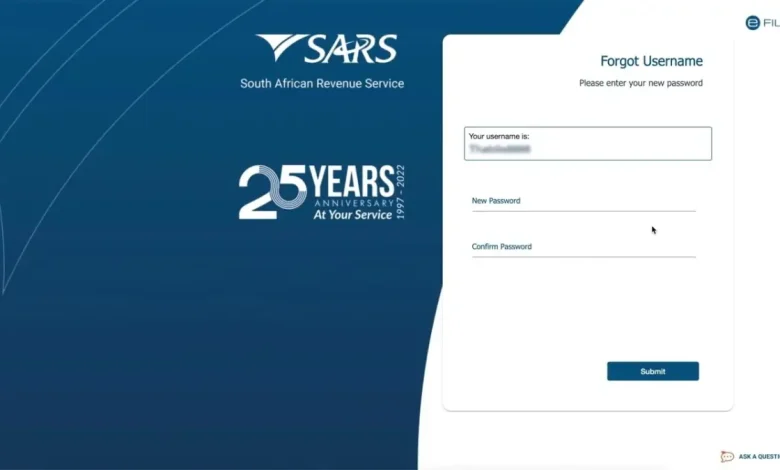

SARS will prompt you to verify your identity. This may involve answering security questions or receiving a verification code via email or SMS. - Create a New Password

Once verified, you will be asked to create a new password. Make sure your new password meets SARS’s security requirements, typically including a mix of uppercase letters, lowercase letters, numbers, and special characters. - Confirm and Submit

Re-enter your new password to confirm it, then submit the form. You will receive a confirmation message indicating your password has been successfully reset.

Tips for Creating a Strong SARS Password

To keep your SARS account secure, follow these password best practices:

- Use at least 8 characters combining letters, numbers, and symbols.

- Avoid common words or easily guessable information like birthdates.

- Change your password regularly to minimize security risks.

- Consider using a reputable password manager to store your credentials safely.

What to Do If You Encounter Issues Resetting Your Password

If you experience problems during the password reset process, such as not receiving the verification code or forgetting your username, don’t worry. You can:

- Check your spam or junk email folder for the verification message.

- Ensure your contact details are up to date in your SARS profile.

- Contact SARS customer support via their toll-free number or online chat for assistance.

- Use the SARS mobile app, which also supports password reset functions.

Benefits of Resetting Your SARS Password Online

Resetting your SARS password online offers several advantages:

- Convenience: No need to travel or wait in queues at SARS branches.

- Speed: Complete the process quickly, often within minutes.

- Security: SARS uses secure verification methods to protect your account.

- Accessibility: Available 24/7, allowing you to reset your password anytime.

Recovering Your SARS Password

Forgetting your SARS tax password is no longer a major setback thanks to the easy online reset options provided by SARS. By following the simple steps outlined above, you can regain access to your tax information swiftly and securely without visiting a branch. Remember to keep your password strong and your contact details updated to ensure a smooth experience. Stay proactive and manage your SARS account confidently from anywhere!

CHECK OUT: Two Types of South African Taxpayers at Risk: What You Need to Know About SARS Scrutiny