How to Apply For a Capitec Bank Loan on The App: A Step-by-Step Guide

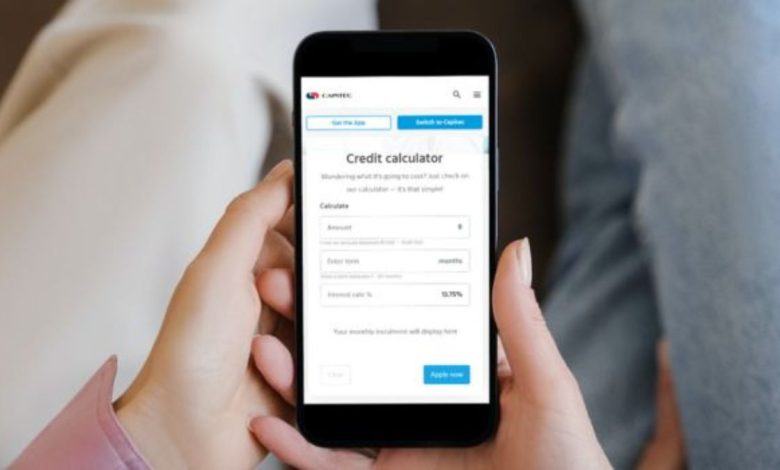

Applying for a personal loan through Capitec Bank has never been easier, especially with their mobile banking app. Whether you’re a new customer or an existing client, the app allows you to access quick loan solutions from the comfort of your home.

This guide provides a comprehensive, step-by-step process on how to apply for a Capitec Bank loan on the app, ensuring a smooth and efficient borrowing experience.

What You Need to Know About Capitec Bank Loans

Before diving into the application process, it’s important to understand the types of loans Capitec offers through the app. Capitec provides personal loans that range from R3,000 to R500,000, depending on your financial profile. These loans can be repaid over terms ranging from 12 months to 84 months. The application process is simple, and with the app, you can receive a loan estimate based on your income and expenses, making it easier to manage your finances.

ALSO READ: South Africans Ditch Using Cash and Cards: Rise of Digital Payments in 2025

Capitec Loan Requirements

To apply for a Capitec Bank loan, you need to meet the following basic requirements:

- You must be 18 years or older.

- You need to have a valid South African ID.

- You must be employed or have a steady source of income.

- You must have a Capitec account, though non-Capitec account holders can also apply, with some additional verification steps.

Once you meet these requirements, you’re ready to begin your application via the mobile app.

How to Apply For a Capitec Bank Loan on The App: A Step-by-Step Guide

Step 1: Download and Install the Capitec App

The first step to applying for a loan is downloading the Capitec mobile banking app. You can find the app in the Google Play Store or the App Store. Once installed, open the app to begin the loan application process.

Step 2: Log in to the App

If you’re an existing Capitec customer, log in using your Remote Banking PIN or biometric login (such as fingerprint or facial recognition). For new users, you will need to register by following a simple onboarding process. This includes verifying your identity through your South African ID number and a selfie.

Step 3: Navigate to the “Credit” Section

Once you’re logged in, navigate to the “Credit” section in the app. This is where you’ll find the loan application options. Tap on “Personalised Credit” to access loan options tailored to your financial situation.

Step 4: Check Your Loan Eligibility

Before applying, the app provides an option to see what loan you may be eligible for. Using the “See What You Could Get” feature, you’ll receive an estimate of your loan eligibility based on your income and credit history. This feature allows you to check your affordability without affecting your credit score.

Step 5: Choose Your Loan Amount and Repayment Term

Once you’ve reviewed your loan eligibility, choose the amount you wish to borrow and the repayment term that best suits your financial needs. Capitec offers flexible repayment periods, ranging from 12 months to 84 months. Take the time to choose a term that you can comfortably manage.

Step 6: Review and Accept the Loan Terms

Next, you’ll be asked to review the loan terms. This includes the loan amount, interest rate, repayment term, and total cost of the loan. Make sure you read through the terms carefully before proceeding. Capitec provides transparent information about loan costs, including interest rates, which can start from 12.75% per annum.

ALSO READ: How to Buy Electricity on the Capitec App: A Step-by-Step Guide

Step 7: Upload Your Supporting Documents

Capitec requires some documentation to process your loan application. This includes:

- A valid South African ID.

- Proof of income (your latest salary slip).

- Bank statements showing your last three consecutive salary deposits if your salary is not paid into a Capitec account.

Upload these documents directly in the app to complete your application. The app’s secure platform ensures your personal information is kept private.

Step 8: Confirm and Submit Your Application

After uploading your documents, double-check all the information for accuracy. If everything looks good, you can submit your application for approval. Capitec will assess your application based on affordability and your creditworthiness.

Step 9: Await Loan Approval

Once you’ve submitted your application, Capitec will process it and notify you of the outcome. If approved, the loan amount will be disbursed to your Capitec account, typically within 24 hours.

Why Use Capitec’s Loan Application App?

Capitec’s mobile app is designed to make the loan application process faster, easier, and more accessible. Applying via the app means you don’t have to visit a branch, saving time and effort. The app’s features, such as loan eligibility estimates and instant access to loan applications, allow for a seamless and transparent borrowing experience.

Capitec also provides affordable personal loans with flexible repayment terms and competitive interest rates. With their simple and secure application process, Capitec ensures that getting a loan is both convenient and reliable.

ALSO READ: How to Track and Check Your Credit Score for Free on the Capitec App

Applying for a Capitec Bank loan on the app is a straightforward process that can be done from the comfort of your own home. By following the steps outlined above, you’ll be able to easily navigate the app, check your eligibility, and apply for a loan that suits your needs. Capitec’s mobile app offers a fast, secure, and convenient way to access the funds you need without any hassle.