New South African Bank Launches to Challenge Capitec

South Africa’s banking sector is experiencing a new wave of competition as new South African bank launches aim to challenge the dominance of long-established players like Capitec. In particular, Old Mutual’s much-anticipated launch of OM Bank signals the entry of a formidable competitor in the digital banking landscape. OM Bank’s strategy is to tap into South Africa’s underserved upper mass market, with Capitec’s market share firmly in its sights.

The Rise of OM Bank: A New Contender in the South African Banking Sector

OM Bank’s entry into the South African banking market comes with a hefty investment of R2.8 billion. Old Mutual bets on its customer base and ability to offer innovative digital banking solutions. The bank targets users earning between R5,000 and R80,000 per month, a segment traditionally served by Capitec. With this strategic positioning, OM Bank seeks to disrupt Capitec’s lead in retail banking.

For more information on recent changes in South Africa’s banking sector, read our article on Absa Shuts Down More ATMs in SA.

Clarence Nethengwe, the CEO of Old Mutual, has spoken about their approach: “We aim to make banking accessible and affordable for South Africans across all walks of life, especially those who need a more streamlined and customer-friendly banking experience.” With the launch of OM Bank, Old Mutual aims to replicate the success Capitec has enjoyed by offering a simple, low-cost alternative to traditional banks.

Key Features of OM Bank: What Sets It Apart

Old Mutual bets on its customer base and ability to offer innovative digital banking solutions. Among these features are:

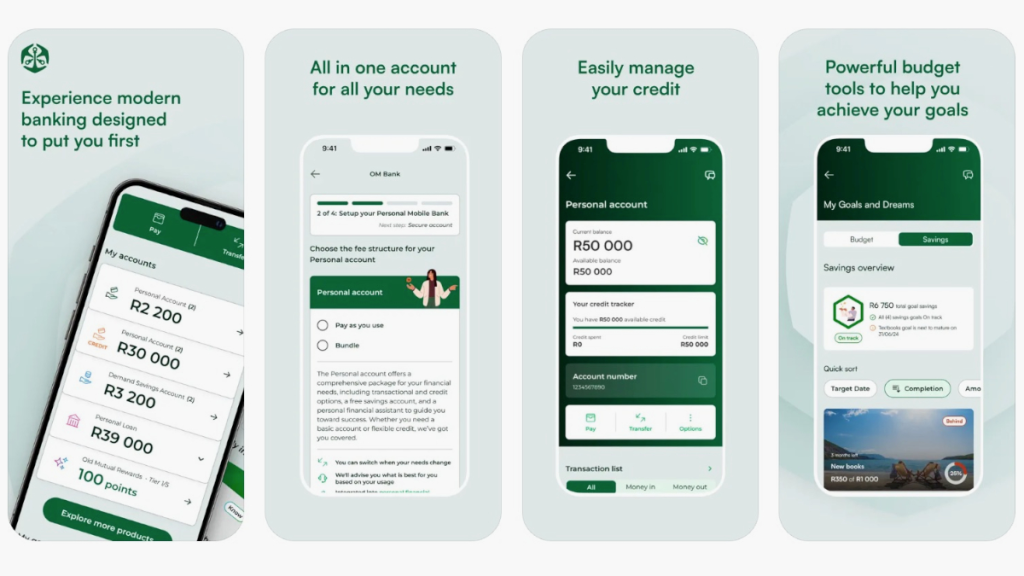

- Simple and Fast Sign-Up Process: One of OM Bank’s standout features is its paperless, quick sign-up process, which can be done in just minutes through the app. This eliminates the hassle of paperwork and allows users to start banking immediately.

- My Mobile Banker: OM Bank’s app includes a personal banking assistant called My Mobile Banker, which helps users track their finances, set budgets, and manage their financial goals. This personalised service offers a level of engagement that Capitec’s app lacks, potentially making it more appealing to tech-savvy customers.

- Rewards Programme: OM Bank offers a rewards programme, where users can earn up to 10% in points on qualifying credit card purchases and 2.5% on debit card purchases. These points can be redeemed for cash, vouchers, or airtime.

- Competitive Fees: With R4.95 monthly fees and a variety of free services, OM Bank’s pricing structure is designed to appeal to cost-conscious consumers. For example, local card purchases are free, and even international card purchases come without additional charges.

OM Bank Fees: Transparent and Competitive Pricing

One of the key aspects of the new bank appeal is its transparent fee structure, designed to be both affordable and competitive in comparison to traditional banks like Capitec. Below is a breakdown of OM Bank’s fees for various banking services:

| Product | Fees |

|---|---|

| Monthly Account Fee | R4.95 |

| Credit Initiation Fee | Free |

| Credit Facility Fee | R69 |

| Cash Withdrawals | R10 per R1,000 (ATM) |

| Cash Withdrawal at Till Point | R2 |

| Cash Deposit at Till Point | Retailer dependent |

| Cash Withdrawal (International) | R70 |

| Currency Conversion Fee | 2.75% |

| Card Purchases (Domestic) | Free |

| Card Purchases (International) | Free |

| Real-Time Payment (RTP & RPP) | Free for values up to R3,000, R1 for values between R3,000 and R50,000, R6 above R50,000 |

| Electronic Funds Transfer (EFT) | Free for values up to R3,000, R1 above R3,000 |

| Debit Order | R3 |

| Airtime & Data | R0.50 |

| Electricity | R1 |

| Bill Payments | R1 |

| Balance Check ATM | R10 (including international) |

Capitec’s Market Leadership and the Growing Competition

Capitec has dominated South Africa’s retail banking sector for years, boasting over 23 million customers. The bank’s focus on offering affordable banking solutions, simplified accounts, and customer-first services has been a significant driver of its success. However, with the entry of OM Bank, this dominance is being challenged.

Despite the rise of new competitors like Discovery Bank, TymeBank, and now OM Bank, Capitec continues to perform well in the market, largely because of its innovative approach and reliable digital platform. Capitec’s ability to adapt and continually offer new products to its customers is one reason it has maintained such a large market share.

To learn more about getting started with Yoco for your business, check out our guide on Where to Buy a Yoco Card Machine for Your Business and How Much It Costs.

OM Bank’s Target Market: The Upper Mass Market and Affluent Lower Segments

OM Bank is targeting South Africa’s upper mass market and lower affluent customers—those earning between R5,000 and R80,000 per month. This market segment is highly competitive, with Capitec already well-established in this space. However, OM Bank sees an opportunity in offering more tailored banking products designed specifically for the needs of these customers.

In particular, OM Bank plans to leverage its 3.1 million existing low-income customers and 400,000 Money Account users to generate initial traction. With Capitec serving a similar demographic, OM Bank’s focus on digital banking solutions, including the ability to easily set up accounts via a mobile app, could help it win over this customer base.

OM Bank’s Pricing Strategy: Competitive Fees and Rewarding Customers

OM Bank’s fee structure is one of the most competitive in the market. A R4.95 monthly account fee and free domestic card purchases make it an attractive option for cost-conscious consumers. Additionally, OM Bank offers low-cost services such as free digital payments, no charge on domestic purchases, and reduced fees on international transactions.

The bank’s rewards programme is another major selling point. Users earn 10% in points on credit card purchases and 2.5% on debit card purchases, redeemable for cash, vouchers, or airtime.

This offers a clear advantage over Capitec’s offerings, which lack a similar rewards programme.

Digital Banking for the Modern South African: The Role of Technology

The growing trend of digital banking is reshaping the financial sector, particularly among younger, more tech-savvy consumers. OM Bank’s focus on providing a seamless, mobile-first banking experience positions it well to capitalise on this trend. Users can access a range of services directly from their phones, making it an appealing choice for those who prefer to handle their banking needs digitally.

In a country where smartphone penetration continues to rise, OM Bank’s strategy to build its platform around mobile devices could help it attract a younger audience that values convenience and ease of use. As South Africans move away from traditional banking, digital-first banks like OM Bank are well-positioned to meet demand.

OM Bank’s Growth Potential: Investment, Innovation, and Expansion Plans

Old Mutual is not just launching a bank; it is creating a long-term vision for OM Bank’s growth. After investing R2.8 billion into the project, the company is committed to additional investments of up to R1.3 billion until 2028, when OM Bank expects to break even. This shows a serious commitment to the long-term success of the bank, with a focus on building a robust digital infrastructure and offering competitive products.

In terms of expansion, OM Bank has ambitious plans. By 2026, the bank aims to expand its offerings to include fixed and notice deposit accounts as well as more lending options. This expansion would further solidify OM Bank’s position as a serious competitor to Capitec and other established banks in the region.

What the Future Holds for OM Bank and Capitec

OM Bank and Capitec’s competition is expected to intensify before OM Bank’s full public launch in the fourth quarter of 2025. OM Bank’s aggressive pricing, innovative features, and Old Mutual’s customer base position it to challenge Capitec.

Capitec’s response to this challenge will likely be an enhancement of its own digital offerings and a continued focus on customer service. As the market becomes more competitive, both players will need to innovate continually to retain their customers and attract new ones.

For details on Capitec’s new services, read our article on Capitec Unveils Plans to Issue Smart IDs and Passports at Branches.

OM Bank’s Role in South Africa’s Banking Revolution

The launch marks a significant shift in South Africa’s banking landscape. OM Bank’s digital-first approach, innovative features, and competitive pricing equip it to compete with Capitec and other major players. OM Bank focuses on the upper mass market and lower affluent segments, positioning itself to disrupt the status quo.

As digital banking becomes more prevalent in South Africa, banks like OM Bank will continue to push for innovative solutions, affordable services, and customer-centric models. The battle for South Africa’s banking customers is far from over, and OM Bank’s entry is sure to make the competition more exciting than ever.