Where Tobacco Tax Money Goes – A Visual Breakdown

Table of contents

- Understanding South Africa’s Tobacco Tax: How Excise Duty Funds Public Health and Economic Development

- What Is Tobacco Tax and How Much Is It?

- What Is a Sin Tax?

- Revenue Generated and Its Importance

- Impact of Tobacco Taxation on Public Behaviour and Economy

- Visual Breakdown: Where Tobacco Tax Money Goes

- What the Tobacco Tax Money Does: Table Summary

- Why Tobacco Taxes Matter Beyond Revenue

- Economic Development

Understanding South Africa’s Tobacco Tax: How Excise Duty Funds Public Health and Economic Development

South Africa’s tobacco excise tax, increased by 4.75% in the 2025/26 budget, contributes significantly to government revenue. It also serves broader public health and social aims. This article explains how tobacco tax money is collected, allocated, and ultimately used to benefit South African society. It is based on the latest fiscal data and government priorities.

In South Africa, tobacco excise taxes are a form of indirect tax levied on the production or sale of tobacco products, primarily to discourage consumption and generate revenue. These taxes are collected by the South African Revenue Service (SARS) and are a significant source of government revenue.

What Is Tobacco Tax and How Much Is It?

Tobacco excise duty is a form of “sin tax.” It is levied on tobacco products to discourage consumption for health reasons while generating revenue. In the 2025 Budget Review, National Treasury increased excise duties on cigarettes, cigarette tobacco, and electronic nicotine delivery systems (vaping) by 4.75%. Additionally, pipe tobacco and cigars saw a 6.75% increase.

What Is a Sin Tax?

These excise taxes, commonly referred to as “Sin Tax,” are levies placed on non-essential items to discourage the consumption of products with negative externalities. In addition to alcohol and tobacco taxes, South Africa maintains a “health promotion tax” on sugary drinks, though this remained unchanged for the current budgetary period. These taxes serve dual purpose, generating government revenue while discouraging the consumption of harmful substances. Furthermore, it alleviates strain on the healthcare system caused by alcohol and tobacco-related health issues and violence.

Excise duties are estimated as a percentage of the retail selling price. It is currently about 40% for the most popular cigarette brands. This tax rise is part of a broader fiscal strategy alongside increased taxes on alcohol. This aims to balance revenue growth with public health goals.

Revenue Generated and Its Importance

The sin tax (covering tobacco, alcohol, and sugary drinks) plays a crucial role in South Africa’s budget. Alcohol tax alone raised R41.5 billion in 2022/23, indicating the scale. Tobacco taxation also contributes a substantial share. It feeds into the national fiscus, part of a total tax revenue estimate of approximately R1.85 trillion for 2024/25.

The tobacco industry makes a significant contribution to the national fiscus, and to the national economy.

However, our ability to contribute to the fiscus has diminished as the illicit sector has thrived. The industry’s Gross Added Value (GVA) to the country’s GDP was R48.4 billion in 2019 – but had dropped to R44.7 billion in 2022.

These revenues help fund government programmes and public services. The associated tax increases intend to reduce consumption of harmful products. This decreases long-term healthcare burdens linked to tobacco-related illnesses.

Impact of Tobacco Taxation on Public Behaviour and Economy

The excise taxes on tobacco are adjusted annually. They are often above the inflation rate and designed to discourage smoking and vaping. Raising prices generally reduces consumption, especially among young people and lower-income groups. This helps to lower smoking rates over time.

Tax policy measures proposed in the 2025 Budget are designed to raise R28 billion in

additional revenue in 2025/26 and R14.5 billion in 2026/27. A VAT increase affects

everyone, and government is mitigating the adverse effects for lower-income households,

including through above-inflation increases to social grants, not increasing the general fuel

levy, and expanding the list of foods zero rated for VAT. Other tax proposals include no

inflation adjustments to medical tax credits, above-inflation increases on alcohol and

tobacco excise duties, and diesel refund relief for primary sectors.

However, these tax hikes also run the risk of fuelling illicit trade, where untaxed tobacco products enter the market. To counteract this, the government enhances enforcement and compliance measures, facilitated by SARS with dedicated resources.

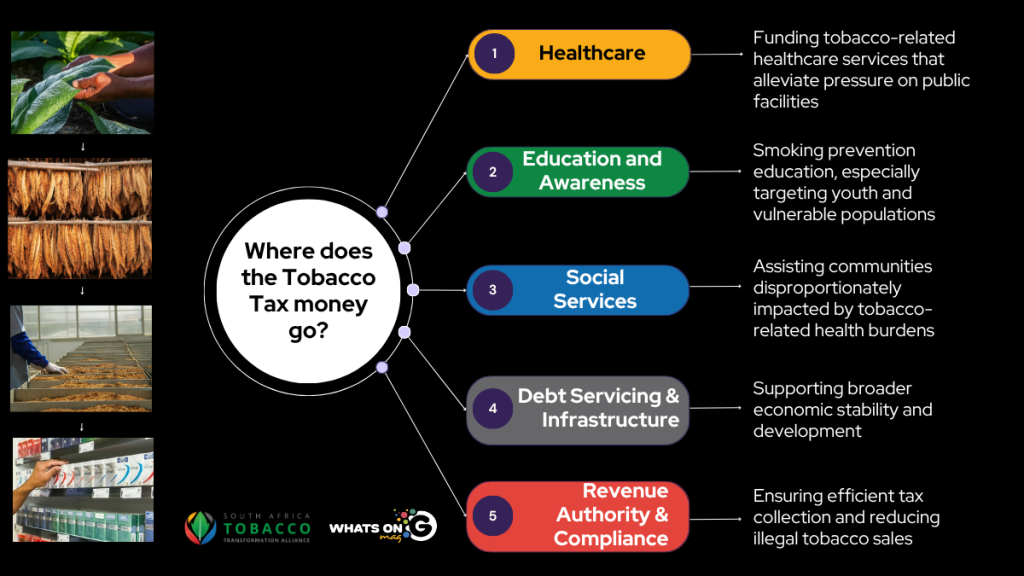

Visual Breakdown: Where Tobacco Tax Money Goes

Tobacco tax revenue flows into the South African government’s general revenue pool. It is allocated as part of the national budget to various public sectors as follows:

Table Expansion

What the Tobacco Tax Money Does: Table Summary

| Allocation Area | Purpose | Description |

|---|---|---|

| Healthcare | Treatment, prevention, and cessation | A key beneficiary is the public health system. Revenue helps finance tobacco cessation programmes, health promotion campaigns, and treatment for tobacco-related diseases such as lung cancer and respiratory illnesses. This reduces the overall burden on healthcare facilities. |

| Social Services | Poverty relief and community support | Funds contribute towards social welfare and poverty reduction initiatives led by government departments. This supports vulnerable communities affected by tobacco-related health disparities. |

| Education and Awareness | Public health campaigns and tobacco cessation programmes | Government runs public health education initiatives aimed at curbing tobacco use, especially amongst youth and vulnerable populations. These communications are partially financed through excise tax revenues. |

| Debt Servicing & Infrastructure | National debt repayment and infrastructure projects | Part of the tobacco tax revenue helps service South Africa’s national debt. Additionally, it contributes to infrastructure development, from transport projects to energy systems, supporting overall economic growth. |

| Revenue Authority & Compliance | Tax collection enforcement and anti-illicit trade operations | A portion of funds supports SARS (South African Revenue Service) in enforcement activities. This includes combating illicit tobacco trade which undermines tax collection and health goals |

Why Tobacco Taxes Matter Beyond Revenue

Tobacco excise duties represent a critical intersection of fiscal policy and public health. While they provide essential government funds, their primary goal is to discourage consumption of harmful products. This dual purpose helps shift behaviour patterns, reduce non-communicable diseases, and lessen healthcare costs in the long term.

Tobacco leaf farming often sustains new generations of farmers and can provide communities with

safer long-term incomes, food security, and access to healthcare and education.

By transparently allocating tobacco tax revenue towards healthcare and social priorities, South Africa strengthens its capacity to address the harms caused by smoking. This benefits wide sectors of society.

Discover the economic toll behind the smokescreen: R28 Billion Lost: The True Cost of Illicit Cigarette Trade in South Africa. Click to uncover the staggering figures and what they mean for everyday South Africans.

Economic Development

South Africa’s tobacco excise tax serves a dual purpose. It generates crucial government revenue while promoting public health objectives by discouraging tobacco consumption. The recent 4.75% increase in tobacco taxes forms part of comprehensive fiscal and health strategies. These are designed to reduce smoking rates, particularly among vulnerable populations. Revenue raised from tobacco taxes is broadly allocated within the national budget, supporting healthcare services, social welfare programmes, public education campaigns, debt servicing, infrastructure projects, and revenue authority operations to combat illicit trade.

This transparent allocation ensures that funds collected contribute not only to fiscal stability but also to reducing the long-term healthcare and social burdens caused by tobacco. As such, tobacco excise duties represent a vital policy tool that balances economic, health, and social priorities for South Africa’s sustainable development.