Step-by-Step Guide to Submitting Your SARS Tax Return on eFiling

Filing your tax return is a crucial annual task for every South African taxpayer. Fortunately, the South African Revenue Service (SARS) makes this process easier with its online eFiling platform. This guide will walk you through each step, ensuring you submit your SARS tax return smoothly and confidently.

ALSO READ: SARS Warns Taxpayers to Double-Check Banking Details Before

Why Use SARS eFiling?

SARS eFiling offers a fast, secure, and convenient way to submit your tax return. You can file from anywhere with an internet connection, at any time of day. Additionally, eFiling reduces the risk of errors and helps you track your submission status. Most importantly, it speeds up the refund process if you are due a payout.

Who Needs to File a Tax Return?

Most South African taxpayers must file a return if they earn above a certain threshold or have multiple sources of income. If you are employed, self-employed, or receive rental or investment income, you likely need to file. Even if you are unsure, it is safer to check and submit if required. Failure to file can result in penalties or interest charges.

How to Register for SARS eFiling

Before you can use eFiling, you must register as a user. Visit the official SARS eFiling website and click on the “Register” button. You will need your valid South African ID, tax reference number, and a valid email address. Follow the prompts to create a username and password. Once registered, log in to your new eFiling account.

Gathering Your Documents

Prepare all necessary documents before starting your return. These may include your IRP5 certificate from your employer, proof of medical expenses, retirement annuity certificates, and any other income or deduction records. Keeping your paperwork organized saves time and reduces mistakes.

Logging into Your SARS eFiling Account

Open your web browser and go to the SARS eFiling portal. Enter your username and password to log in. If you forget your login details, use the “Forgot Password” or “Forgot Username” links. Once logged in, you will see your dashboard with various options.

Starting Your Tax Return

From your dashboard, select the “Returns” tab and then choose “Income Tax Return.” SARS will guide you through a series of questions to determine which forms you need to complete. Answer each question honestly and carefully. Double-check your responses to avoid errors.

Filling in Your Tax Return

Enter your personal information, income details, and any deductions or exemptions you qualify for. Use the information from your documents to ensure accuracy. If you are unsure about any section, consult the help guides or contact SARS for assistance. Take your time to review each field before moving to the next step.

READ MORE: SARS Tax Return Process Explained for Taxpayers

Uploading Supporting Documents

If SARS requests additional documents, upload them directly through the eFiling portal. Acceptable file formats include PDF and JPEG. Uploading supporting documents helps SARS process your return faster and reduces the risk of queries or delays.

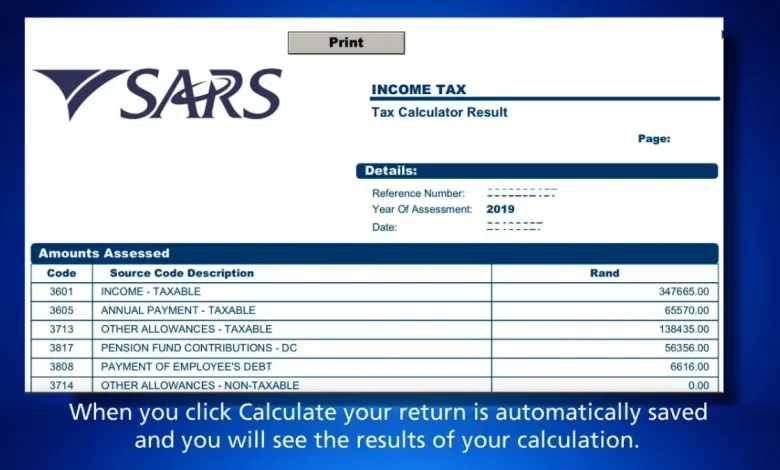

Reviewing and Submitting Your Return

Before submitting, review your entire return for accuracy. Check that all income, deductions, and personal details are correct. Make any necessary corrections. Once you are satisfied, click the “Submit” button. You will receive a confirmation that your return has been successfully submitted.

What Happens After Submission?

SARS will process your return and may request further information if needed. You can check the status of your return on your eFiling dashboard. If you are due a refund, it will be paid into your nominated bank account. If you owe tax, SARS will notify you of the amount and due date.

Tips for a Smooth eFiling Experience

File early to avoid last-minute stress and system overloads. Keep copies of all documents and correspondence with SARS. Update your contact details if they change. If you encounter technical issues, use the Help Centre or contact SARS directly.

Troubleshooting Common Issues

If you forget your password, use the recovery options on the login page. For technical errors, clear your browser cache or try a different browser. If you receive a query from SARS, respond promptly with the requested information. Staying proactive helps resolve issues quickly.

The Benefits of Using SARS eFiling

SARS eFiling saves time, reduces paperwork, and provides instant confirmation of your submission. It also allows you to track your refund status and access previous tax returns. Using eFiling regularly helps you stay compliant and organized.

Take Control of Your Taxes

Submitting your SARS tax return on eFiling is straightforward once you know the steps. By following this guide, you can file accurately and on time. Take advantage of the convenience and security of SARS eFiling to manage your tax obligations with confidence.