From Zimbabwe To Johannesburg: Inside South Africa’s Illegal Cigarette Smuggling Network

South Africa’s illegal cigarette trade is a growing concern. It impacts both the economy and public health. A significant portion of the contraband originates from Zimbabwe. The tobacco industry thrives there due to lower taxes and lax regulation. This article takes a closer look at how smuggled cigarettes flow from Zimbabwe’s tobacco farms into South African cities, particularly Johannesburg. It highlights the methods used by smugglers, the impact on the economy, and the ongoing efforts to combat this illicit activity.

Curious how illicit cigarettes drain the economy? Discover the full financial impact and what it means for South Africa. R28 Billion Lost: The True Cost of Illicit Cigarette Trade in South Africa. Click to read the full story!

Table of contents

A Seizure That Illustrates the Scale of the Trade

In early 2025, a major interception of illicit cigarettes took place at the Beitbridge border post. Nearly R14 million worth of contraband was seized. This bust is just one of many that highlight the sophistication and scale of the smuggling operations. Cigarettes, often smuggled in bulk, enter South Africa from Zimbabwe. They come through official and unofficial crossing points. This creates significant challenges for law enforcement agencies. The seizure underscored the massive volumes of illicit goods that flood into the country. Furthermore, smuggling routes reach as far as Johannesburg.

The Scale and Impact of Cigarette Smuggling

It is estimated that nearly two-thirds of all cigarettes sold in South Africa are illicit. A substantial portion of these are smuggled from Zimbabwe. Consequently, this thriving black market costs South Africa more than R27 billion in lost tax revenue each year. This shortfall undermines critical public services such as healthcare, education, and infrastructure development. The impact is not only financial; the proliferation of illicit cigarettes also distorts the legitimate tobacco market, making it harder for lawful businesses to survive.

Illicit Import/Export

a. Smuggling

Products are illegally traded across borders without paying taxes. Both legal and illegal tobacco products can be smuggled. They are brought into the country at both legal and illegal entry points without paying import duties and are then sold without paying excise duties or VAT. These products may or may not meet health or other legal requirements.

b. Bootlegging

Small-scale smuggling where an individual purchases cigarettes in one country, where the taxes are low, and sells them in another country where taxes are higher.

c. In Transit

Tobacco products are produced for export by a legitimate manufacturer but are smuggled to a different country en route without paying any tax.

The tax evasion linked to this trade creates a ripple effect that harms both consumers and the state. Moreover, smuggling fuels organised crime. Criminal syndicates involved in the illicit tobacco trade often expand their activities into other illegal sectors, including drug trafficking and human smuggling.

South Africa loses close to R7 billion a year because of illicit tobacco trade, according to Business Leadership South Africa (BLSA) who suggest that the largest share of the illicit cigarette market is occupied by those manufactured locally, with other brands smuggled from neighbouring countries like Mozambique and Zimbabwe making up the rest.

Why Zimbabwe?

Zimbabwe plays a central role in the illicit cigarette trade due to its significantly lower tobacco taxes compared to South Africa. This tax disparity creates an opportunity for smugglers to profit from the price difference. Cigarette boxes, which can be purchased for around USD 120 in Zimbabwe, are sold to smugglers for USD 250-300. Once they cross the border into South Africa, the same boxes can fetch as much as R15,000 on the black market.

Popular Zimbabwean brands such as Remington Gold, Pacific, Mega, Dullahs, Branson, and Servilles dominate the South African illicit market. These products are often manufactured by companies like Gold Leaf Tobacco Corporation (GLTC). GLTC has faced criticism for its involvement in tax evasion and money laundering schemes.

The National Prosecuting Authority (NPA) alleges the couple imported cigarettes from Zimbabwe and then falsely claimed they were shipped to Mozambique when they were, in fact, sold in South Africa without duties or VAT payments. This sort of tax evasion is typical of the illicit tobacco sector, and we welcome the positive developments in this case.

SATTA also welcomes the decision by the Supreme Court of Appeal to allow SARS’ evidence of illegal tobacco dealing to be submitted as evidence in the criminal trial against Walter and Letisha Cyril, who face 164 counts of tax fraud charges regarding illicit cigarettes. The couple, former directors of companies CEW Logistics and Tish Maritime, allegedly formed part of a R120m fraud scheme with some SARS officials selling contraband cigarettes.

Smuggling Routes and Methods: A Complex Web

The primary smuggling route for illicit cigarettes runs from Zimbabwe into South Africa through the Beitbridge border post. However, many smugglers take advantage of various illegal crossing points along the Limpopo River. Some traffickers exploit official border crossings by bribing customs officers. This enables them to overlook their illegal cargo. Others use more covert tactics, including transporting cigarettes in smaller vehicles or hiding them in trucks. These trucks appear to be carrying legitimate goods. In some cases, smugglers even use boats to cross the river under the cover of darkness.

With more than 100 000 informal outlets countrywide and without the current excise tax of around R17.85 per packet that consumers have to pay on the formal market, official sales have all but collapsed in some provinces, Van Staden said.

“We have sourced some of the leaf used by illegal manufacturers and it’s not local. It comes from countries like Zimbabwe and it is crippling our country’s formal tobacco sector.” Research consultancy Ipsos has also indicated that illegal sales are gaining traction hand over fist. Its market share last year spiked from 33% to 42%.

The transit of illicit cigarettes is often carried out by local transporters. They receive between R100 and R300 per box for moving the contraband across the border into South Africa. These networks are well-organised and operate with considerable skill and secrecy. In some instances, smugglers have even devised ingenious methods to avoid detection. They use decoys or modify vehicles to appear as if they are carrying normal freight.

The Directorate for Priority Crime Investigation (Hawks) conducted a raid on five alleged smugglers and seized illicit cigarettes worth R30 million at a farm situated between Musina and Beitbridge border post this week.

Hawks spokesperson, Captain Matimba Maluleke, stated that the specialized team was “extremely determined” to combat the smuggling of illicit cigarettes in the country by “dismantling and paralyzing the syndicate operations.”

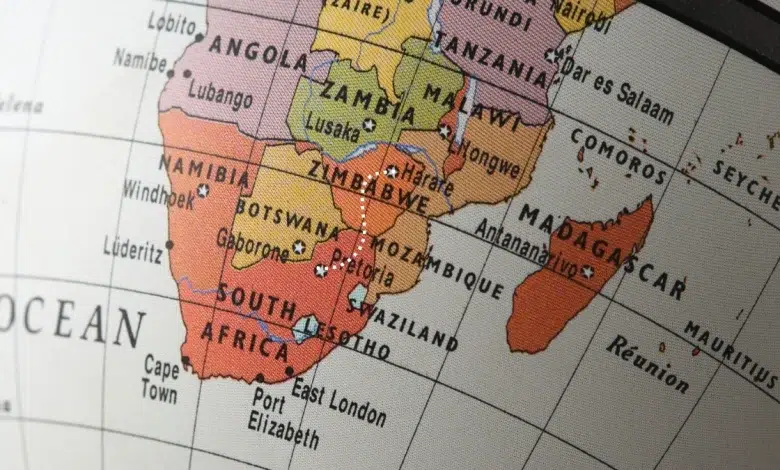

A visual map illustrating these key smuggling routes would provide clarity. It would show how cigarettes flow from production areas in Zimbabwe to urban centres in South Africa, particularly Johannesburg.

The Role of Organised Crime

The illicit cigarette trade is not a simple operation; it is driven by well-established criminal syndicates. These groups are often part of a larger network that spans multiple countries. Smuggling operations involve complex relationships between Zimbabwean exporters and South African middlemen. In some cases, international criminal entities are also involved. The scale of the operation is such that enforcement becomes increasingly difficult. This is due to the layers of corruption and money laundering.

Speaking at the Tobacco Institute of Southern Africa’s (Tisa) anti-illicit trade conference in Cape Town yesterday (Tuesday), Sotyu was cited by several news sources as saying that about 60% of illicit cigarettes were manufactured in South Africa, in both approved factories and illegal covert operations.

According to her, the rest of the illicit tobacco products were smuggled in, predominantly from Zimbabwe as well as Dubai, China, Botswana, Swaziland and Lesotho.

In addition to economic harm, the smuggling trade fuels broader criminal activities, such as drug trafficking and human smuggling. These activities exacerbate security risks in both South Africa and Zimbabwe. By operating with increasing sophistication, these networks complicate efforts to break the cycle of illegal trade and organised crime.

He pointed out that the average export price for raw tobacco from Zimbabwe had been US$4.85/kg in 2018 while the average price for cigarettes was US$32/kg. “By exporting the same amount of kgs (after factoring in weight losses in manufacturing), Zimbabwe could have realised $5.8 billion in one year,” said Bhoroma.

Efforts to Combat the Network

South African authorities, including the South African Revenue Service (SARS), Customs Division, and the police, have ramped up enforcement efforts in recent years. Crackdowns have resulted in the seizure of millions of rands’ worth of illicit goods and the arrest of key figures involved in smuggling rings. The cooperation between South African and Zimbabwean law enforcement has also intensified. Joint operations target key smuggling routes and illegal border crossings.

In 2025, SARS and the police seized several large shipments of illicit cigarettes and froze assets linked to tobacco firms suspected of tax evasion. However, experts warn that the fight against cigarette smuggling requires more than just enforcement. Structural issues, such as the tax disparity between Zimbabwe and South Africa, must be addressed. This is essential to make significant progress against smuggling activities.

Learn How to Spot A Fake Cigarette Pack and the simple signs to differentiate real from counterfeit packs and protect yourself. Click to uncover the checklist now!

What Needs to Be Done?

While enforcement is essential, it will not solve the problem on its own. Experts argue that the underlying economic drivers of the illicit cigarette trade must be tackled. These include the tax differences between Zimbabwe and South Africa. If the market is to be curbed effectively, raising taxes in South Africa could inadvertently increase smuggling. This can happen without a coordinated effort with Zimbabwe to close loopholes. Therefore, stronger regional cooperation and coordinated legal reforms are necessary to reduce the incentives for smuggling.

Consumers also play a critical role in this fight. Purchasing illicit cigarettes fuels organised crime and perpetuates a cycle of criminal activity. South Africans are encouraged to buy legal cigarettes, report suspected smuggling, and support anti-smuggling initiatives.