South African Women Driving Property Market Growth in the R500k to R1 million Range

Table of contents

- Women Lead South Africa’s Property Market Transformation

- Rising Female Ownership in Numbers

- Why Women Prefer the R500k to R1 Million Band

- Diversity in Property Types and Locations

- Socioeconomic Challenges and Opportunities

- Stories of Empowerment

- Impact on Communities and Economies

- Government and Financial Sector Support

- The Future Outlook

- Practical Advice for Female Buyers

- Women as Market Leaders

Women Lead South Africa’s Property Market Transformation

South African women are now the leading force driving growth in the country’s property market, particularly in the R500 000 to R1 million price range. Recent data confirms that women, whether buying alone or jointly, own approximately 71% of all residential properties in South Africa as of 2025. This remarkable shift reflects a new era of female empowerment and financial independence transforming the real estate landscape.

ALSO READ: Tupperware Makes a Come Back by Launching Eco-Friendly Voila Glass Range

Rising Female Ownership in Numbers

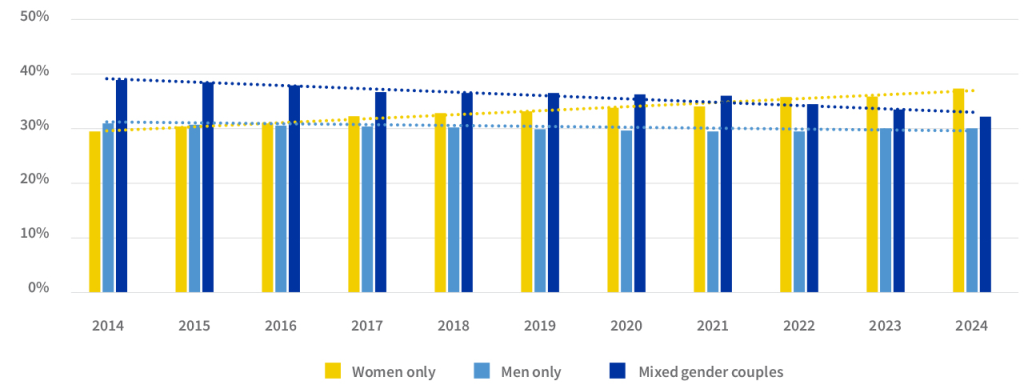

Lightstone and industry reports indicate that women-only buyers hold 38% of residential properties, accounting for around 2.15 million homes. Men-only buyers hold approximately 29%, with joint male-female ownership making up the rest. The rise of women sole buyers has been steady since 2016, and women now dominate all property price segments below R1 million, especially between R500 000 and R1 million.

Why Women Prefer the R500k to R1 Million Band

Women’s preference for homes in the R500 000 to R1 million range is influenced by several factors:

- Financial independence: More women enter the property market as they secure jobs and income.

- Investment goals: Property ownership is seen as a vehicle for wealth-building and long-term security.

- Lifestyle needs: Lock-up-and-go sectional titles and estates appeal to women’s desire for safety and manageable maintenance.

- Government support: Measures like transfer duty exemptions and home loan schemes aimed at young professionals lower barriers to ownership.

Diversity in Property Types and Locations

Women tend to favour sectional titles, estates, and freehold homes that offer security and convenience. Sectional titles account for 37% of purchases by women. Geographic hotspots include Gauteng, Western Cape, Eastern Cape, and KwaZulu-Natal, where female homebuyers are particularly active.

Socioeconomic Challenges and Opportunities

Despite this progress, challenges remain. Women often purchase lower-value properties compared to men, reflecting broader economic imbalances like the gender pay gap. Single women’s homeownership has surged, particularly among older demographics, due to factors such as widowhood and financial planning for retirement.

Stories of Empowerment

Real stories from South African women illustrate this trend. For example, single women across the country are becoming repeat buyers, investing in multiple properties to build financial security for themselves and their families.

Impact on Communities and Economies

Women’s growing control over property ownership contributes to community stability and economic empowerment. Female homeowners are likely to invest more in household and neighbourhood improvements, fostering stronger communities.

Government and Financial Sector Support

Banks and government initiatives have responded to this growing market segment by designing tailored products and incentives for female buyers. Home loans supporting up to 110% financing and targeted education campaigns help women overcome traditional barriers.

The Future Outlook

Industry experts predict that by 2030, women will lead up to 70% of new home purchases in South Africa. The trend towards female financial independence and property ownership is expected to strengthen, reshaping economic dynamics and property market trends.

Practical Advice for Female Buyers

Women entering or expanding in the property market should consider:

- Assessing affordability aligned with long-term financial planning.

- Exploring government grants and favoured home loan products.

- Prioritising properties in secure, convenient locations.

- Building networks with female property investors and agents for support and advice.

Redecorating doesn’t have to break the bank. Explore stylish and affordable furniture pieces under R2000 to refresh your living space on a budget. Mr Price Home Furniture Under R2000 – Budget-Friendly Finds for Your Home. Explore these cute décor options.

Women as Market Leaders

South African women have decisively become key players in the residential property market. Their preference for homes priced between R500 000 and R1 million reflects financial prudence, lifestyle priorities, and growing economic agency. This demographic shift signals a broader transformation in wealth-building and empowerment, benefiting not only women but South African society as a whole.