Minimum Collectable Tax Price Explained: Don’t Get Caught with Illegal Smokes

Understanding the Minimum Collectable Tax (MCT) on Cigarettes

The South African tobacco industry is grappling with the growing issue of illicit cigarette sales, which cost the government billions in lost tax revenue each year. To combat this, authorities introduced the Minimum Collectable Tax (MCT) price, which sets the legal minimum selling price for a pack of cigarettes in South Africa, and it helps to curb the illegal trade. Understanding the MCT is essential for consumers, retailers, and law enforcement to avoid illegal tobacco products. Moreover, it ensures compliance with the law. Let’s take a deeper look at the MCT, its significance, and how it’s helping to fight illegal cigarettes in South Africa.

Ever wondered where your tobacco tax revenue goes? Dive into Where Tobacco Tax Money Goes – A Visual Breakdown and see the story behind the numbers, presented in a clear, eye-catching way. Click to explore!

What is the Minimum Collectable Tax (MCT)?

The Minimum Collectable Tax (MCT) is the minimum price at which a pack of 20 cigarettes can be legally sold in South Africa. This price includes both:

- Excise duties

- Value Added Tax (VAT)

Manufacturers and importers must pay these taxes before releasing cigarettes into the market. For 2025, authorities have set the MCT at R26.22 per pack of 20 cigarettes. Of this, R22.81 accounts for the excise tax, and VAT makes up the remainder.

Selling cigarettes below the MCT price is illegal. If cigarettes are being sold for less than R26.22, they are likely untaxed or illicit. The MCT ensures that tobacco products are properly taxed. It also helps consumers and retailers distinguish between legal and illegal cigarettes.

Why is the MCT Important?

The MCT actively combats South Africa’s illicit cigarette market, which local experts estimate accounts for two-thirds of all cigarette sales in the country. By setting a minimum price, the MCT helps prevent the loss of valuable government revenue. This revenue would otherwise be spent on public services and infrastructure development.

- Illicit products are often of lower quality, posing significant health risks to consumers.

- Retailers selling below the MCT face hefty fines, product seizures, and penalties. Law enforcement and the South African Revenue Service (SARS) rely on the MCT price to identify and confiscate illegal cigarettes.

Challenges with Illicit Cigarettes in South Africa

Despite efforts to curb the problem, the illegal tobacco market remains a significant issue in South Africa. A recent 2025 market survey found that over 75% of retailers were selling cigarettes below the MCT price. Some regions were offering cigarettes for as little as R10 to R18, far below the legal price of R26.22.

Local manufacturers and distributors drive this illicit trade by evading taxes. It costs the government an estimated R28 billion annually. The illegal market’s rapid growth outpaces SARS’s efforts to collect taxes. This growth has prompted calls for stricter regulations to control the issue.

It is just not possible to be tax-compliant and still sell a packet of 20 cigarettes at these low prices, given that the Minimum Collectible Tax (MCT) alone on these packets is R25.05. In fact, recent research commissioned by SATTA, as well as independent research from the University of Cape Town, shows that the minimum price at which a legal pack of 20 cigarettes can be sold is around R32.

These recent findings from Ipsos should increase concern about the future of the legal industry, and what it means for consumers and the national fiscus. SATTA believes we are close to the point where the legal industry is completely pushed out of the market and could collapse, leaving criminal networks completely in charge of cigarette manufacturing and sales.

That means no excise or VAT revenue from cigarettes for SARS. No contribution to the national fiscus. No work or income for people in the legal tobacco industry. And no access to legal products for South African consumers.

Recent Changes to the MCT and Excise Duty

In the 2025 National Budget, Finance Minister Enoch Godongwana announced a 4.75% increase in excise duties on cigarettes. This hike raised the excise tax from R21.77 to R22.81 per pack of 20. The government aims to reduce tobacco use and raise state revenue through these increases, but critics argue that steep tax hikes could inadvertently fuel the illicit market. This happens as the price gap between legal and illegal cigarettes widens.

How to Avoid Buying Illegal Cigarettes

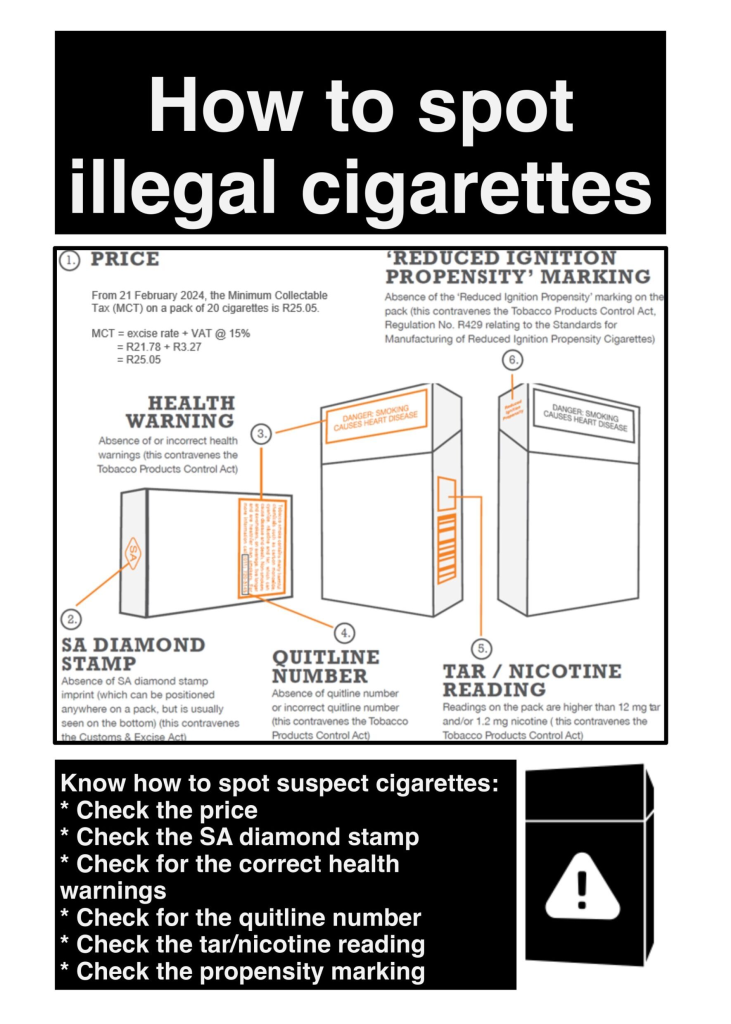

Consumers should be cautious when purchasing cigarettes to avoid buying illegal, cheaper products. Here are a few simple tips to ensure you’re purchasing legal cigarettes:

- Buy only from reputable retailers: Make sure they are licensed to sell tobacco products.

- Check that the price meets or exceeds R26.22 per pack. Cigarettes sold for less are likely to be illegal.

- Look for official tax stamps and health warnings on cigarette packs.

- Report suspicious vendors selling unusually cheap cigarettes to SARS or local law enforcement.

Efforts to Combat the Illicit Tobacco Trade

SARS, in collaboration with other agencies, is intensifying efforts to tackle the illegal tobacco market. These efforts include:

- Raids

- Arrests

- Freezing assets of illegal tobacco manufacturers and distributors

In 2022 and 2024, SARS successfully cracked down on companies involved in money laundering and tax evasion related to tobacco products.

The government is also in the process of updating tobacco control legislation. However, some new regulations could unintentionally drive the illicit market further if not carefully planned.

Major tobacco companies, such as British American Tobacco South Africa (BATSA), support the idea of introducing a legally enforceable minimum retail price. They propose a price of R28 per pack to improve enforcement and help raise consumer awareness about the risks of illegal cigarettes.

Find out how the R28 Billion Lost To The Illicit Cigarette Trade in South Africa impacts the economy and what’s at stake. Read more on the matter.

Stay Informed and Support Legal Tobacco Trade

Understanding the Minimum Collectable Tax and its legal implications is crucial for fighting the illicit tobacco trade in South Africa. By adhering to the MCT, consumers and retailers play a key role in ensuring that tobacco products are legally sold and correctly taxed. This benefits both the government and public health.

The MCT price serves as a key benchmark, helping consumers identify and avoid illegal tobacco products. As the illicit trade continues to grow, it’s vital for consumers and retailers to stay informed, follow legal pricing guidelines, and support efforts to reduce illegal cigarette sales.

By purchasing legal products, South Africans contribute to a healthier economy and society. Stay on the right side of the law; understand the Minimum Collectible Tax (MCT) and choose legal cigarettes wisely.