Massive Fine for Illegal Cigarette Sales – What South African Retailers Must Know

South African retailers face growing scrutiny as authorities clamp down on illegal cigarette sales. A recent fine of R500 000 sends a strong warning: non-compliance with tobacco laws can have severe consequences. This article explains what retailers must know to stay within the law and avoid such penalties.

Why Cheap Cigarettes Keep Hooking South Africa’s Youth & How to Stop It. Discover the link between low-cost tobacco and rising youth smoking rates, plus the urgent steps needed to curb the trend.

Table of contents

The R500 000 Fine: A Wake-Up Call

In a high-profile case, a South African retailer was fined R500 000 for selling illegal cigarettes. The incident, handled by law enforcement agencies in collaboration with South African Revenue Service (SARS), highlights the diligence of authorities in targeting illicit trade. This hefty penalty underlines the urgency for all retailers to ensure their cigarette stock complies fully with regulations.

Understanding the Violation

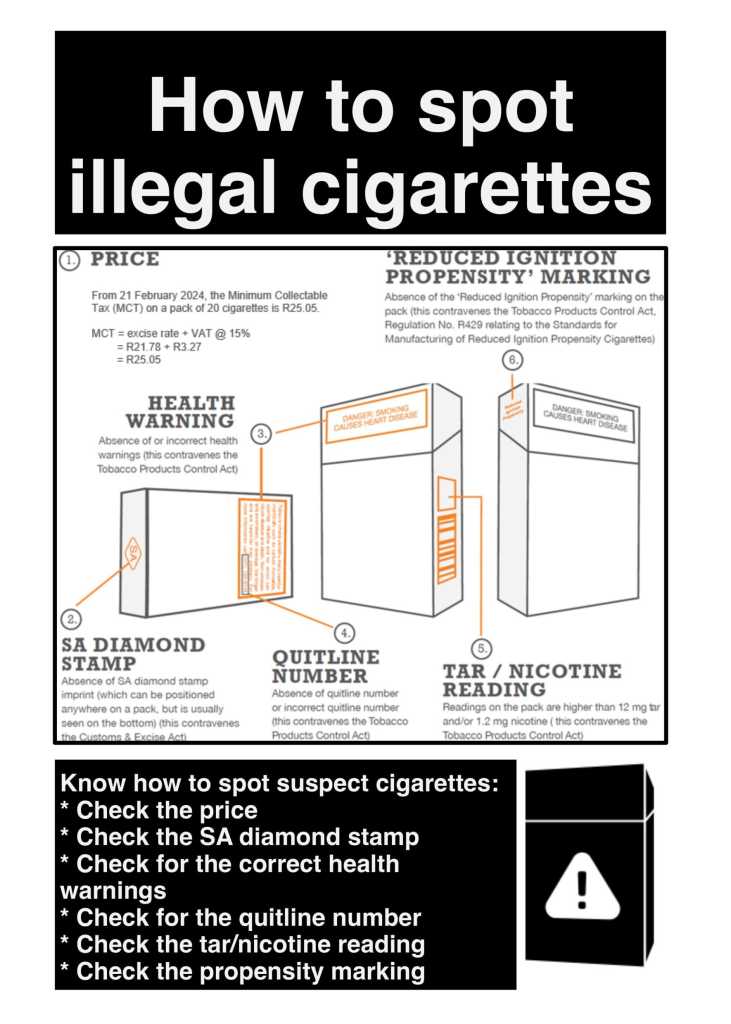

Illegal cigarette sales involve distribution without proper excise duty payment, absence of the mandatory diamond stamp on packs, or selling below the government-mandated minimum price. These offences undermine state revenue and fuel a booming illicit market estimated to cost South Africa R28 billion annually, according to the South African Tobacco Transformation Alliance (SATTA).

Legal Framework for Cigarette Sales

South Africa’s tobacco laws are strict. Key requirements include:

- Payment of excise duty to SARS on all cigarette products.

- Affixing the official diamond-shaped excise stamp on each pack, confirming tax payment and authenticity.

- Adhering to the Minimum Collectable Tax Price (MCTP), which sets a legal price floor for cigarettes to prevent undercutting.

These measures aim to regulate the market, protect consumers, and preserve government tax income.

Consequences of Non-Compliance

Retailers violating tobacco laws risk harsh outcomes:

- Fines can reach hundreds of thousands of rands, as seen in the recent R500 000 penalty.

- Persistent violations may lead to temporary or permanent closure of the business.

- Legal prosecution can involve criminal charges, including imprisonment for repeat offenders.

- Reputational damage affects relationships with suppliers, customers, and regulatory bodies.

The cost of ignoring compliance far outweighs the short-term gains from illicit sales.

Retailer Compliance Checklist

Retailers must take proactive steps to stay compliant:

- Verify cigarette stock sources: Buy only from licensed manufacturers or approved distributors.

- Check for the diamond excise stamp: Ensure every pack bears the official tax stamp before sale.

- Maintain proof of purchase: Keep invoices and documentation for all tobacco stock.

- Follow pricing rules: Do not sell cigarettes below the Minimum Collectable Tax Price.

- Train staff: Educate employees on tobacco laws and compliance requirements.

- Monitor stock regularly: Conduct audits to detect and remove illegal products promptly.

- Report suspicious suppliers or products to authorities via SATTA or SARS portals.

Following this checklist helps retailers avoid fines and contributes to dismantling illicit trade.

A Call to Action for Retailers

Retailers are key partners in South Africa’s fight against illicit cigarettes. The recent R500 000 fine is a clear message: authorities are tightening enforcement. Retailers should immediately review their compliance status and take corrective action where necessary.

SATTA provides resources and support for retailers seeking to understand and meet their obligations. Retailers can access guidance and report illegal activity confidentially through SATTA’s online platforms. Proactive cooperation with authorities protects businesses and supports the legal tobacco industry, sustaining jobs and government revenue.

Stay Ahead of Enforcement

As illicit cigarette trade threatens South Africa’s economy, law enforcement and SARS are increasing inspections and prosecutions. Retailers must stay informed about regulatory changes and enforce internal controls rigorously.

By committing to full compliance, retailers not only avoid heavy penalties but also help curb illegal trade that harms the industry and the community. The commitment today secures a sustainable business future tomorrow.